In Ontario, special rules apply to the matrimonial home upon marriage breakdown. These special rules impact the equalization of property, a spouse’s rights to occupy the home and the sale of the home.

Section 18(1) of Ontario’s Family Law Act defines a “matrimonial home” as “every property in which a person has an interest and that is or, if the spouses have separated, was at the time of separation ordinarily occupied by the person and his or her spouse as their family residence.

In some cases, more than one residence may be deemed a matrimonial home. A common example of where there is more than one matrimonial home occurs where a family has an interest in and extensively uses a cottage property. In determining whether a cottage is a second matrimonial home, the courts will consider whether: (a) if the property is ordinarily used by the spouses; and (b) if it is used as a family residence. In considering the latter of these two criteria, a Court has interpreted the phrase “family residence” as something more than simple use of a cottage. In so doing, a Court will consider the contributions to a cottage property by both spouses when determining whether a cottage may be considered as a second matrimonial home.

The finding that a property is a matrimonial home is critical for the following reasons:

Matrimonial homes are treated differently than other property when they are owned by one spouse on the date of marriage. Generally speaking, when a spouse owns property on the date of marriage that spouse will be entitled to deduct the value of that property in determining their net family property (for an explanation of the equalization calculation, please refer to our property division page. However, if the property owned at the date of marriage is the parties’ matrimonial home at the date of separation, the spouse who owned the property on the date of marriage will not be entitled to deduct that value in determining their net family property. Instead, the entire value of the property as of the date of separation will be included in their net family property for the purposes of equalization.

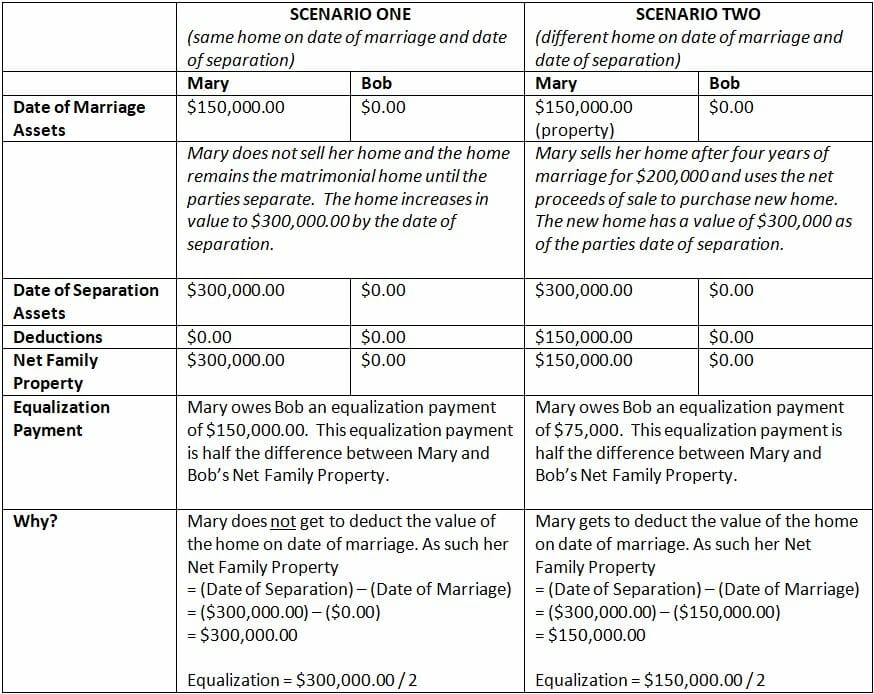

For instance, consider a situation where Bob and Mary get married. Mary owns a home solely in her name on the date of marriage. When the parties marry, the equity in the home is approximately $150,000.00. Six years later, Mary and Bob separate. The equity in Mary’s home is now $300,000.00. As Mary and Bob continue to reside in Mary’s home (the matrimonial home), Mary will not be entitled to deduct $150,000.00 (the equity in the home as of date of marriage) from her net family property. Instead, the entire equity in the home – $300,000.00 – will be subject to equalization.

On the other hand, consider a slight change to the above noted example. After five years of marriage, Mary sells her home. The parties use the proceeds of sale to purchase a jointly-owned property. The following year, Mary and Bob separate. In this scenario, the parties’ matrimonial home (the home where they ordinarily reside on date of separation) is different from the home Mary owned on date of marriage. As such, Mary is entitled to deducted the equity in the home as of the date of marriage (i.e. $150,000.00) when calculating her net family property. As a result of this deduction, Mary’s net family property is significantly reduced in comparison to the previous example. The following chart summarizes two scenarios detailed above without considering any other assets or debts between the parties:

If a property is deemed to be a matrimonial home, both spouses have equal right to possess or occupy the property regardless of which spouse is registered on title, and provided there is no court order to the contrary. That is, upon separation both spouses will have the right to remain in the matrimonial home even if only one spouse is registered on title to the property. The right to possess/occupy the matrimonial home terminates when the spouses divorce, unless a court order or separation agreement explicitly states otherwise.

Following separation, either spouse may request an order for “exclusive possession” of the matrimonial home and/or its contents under section 24 of the Family Law Act. An Order under this section grants one spouse exclusive occupancy of the property and prevents the other spouse from attending the property. In determining the merits of a claim for exclusive possession, a court will consider the following factors:

After a careful analysis of the above-detailed factors, a court may grant exclusive possession to either spouse.

Pursuant to section 20 of the Family Law Act, one or both spouses may designate a property owned by one or both of them as a matrimonial home. A matrimonial home designation is registered against title and will prevent the sale of the property unless both spouses consent to the sale.

Referring back to scenario #1 from earlier, Bob can designate the parties’ home as a matrimonial home despite not being registered on title to the property. This designation would prevent Mary from selling the property without his consent. As such, a matrimonial home designation is an effective tool for a spouse who fears that their spouse may attempt to sell their matrimonial home without their knowledge or consent.

For more information on matrimonial homes and property division, please contact Morrison Williams for a free initial consultation.